Your City. Your Market. Your Next Deal.Stay up to date on national urban real estate |

|

📅 Today's Story: Recent data reveals that central business districts (CBDs) are bouncing back post-pandemic as lower crime rates, rising foot traffic, and strong apartment demand reestablish CBDs as investment-worthy locations for multifamily development.

📝 Editor's Note: After a few weeks of internal tweaks, our weekly roundup is back. Check out our biggest hit stories from last week, with a new featured story to boot. Happy Monday, and thank you for subscribing to Urbanize.

MULTIFAMILY

Urban Comeback: CBD Multifamily Living Rebounds |

|

After lagging the suburbs for a few years, CBDs are back in action—and outperforming as always.

📰 What Happened: After a pandemic-induced exodus, central business districts (CBDs) are showing strong signs of recovery. According to recent data from Cushman & Wakefield, crime rates are down, population growth has resumed, and foot traffic is rebounding—especially among residents. Naturally, CBD multifamily fundamentals are once again attracting investors.

🔍 A Closer Look: Apartment demand in CBDs has historically outperformed the suburbs, except during the early pandemic. Even with high supply, fundamentals remain strong: stabilized vacancy is low, rent growth is accelerating, and rent premiums have narrowed, making urban living more attainable. Despite early post-pandemic skepticism, cap rates for CBD properties also remain attractive, and transactions have been outpacing the suburbs.

🧠 Why It Matters: For city residents and investors alike, it feels like CBDs may finally be back on track. Encouraging multifamily development in CBDs not only supports housing but also drives broader urban revitalization. Notably, though CBDs comprise just 3% of city land, they generate outsized value, accounting for over 25% of real estate value and 50% of GDP.

Despite falling behind the suburbs in 2021 and 2022, CBDs were back in the lead by 2023.

| DowntownPhotos: Centennial Yards unveils first new tower, now seeking renters 304-unit luxury venture The Mitchell stands near Mercedes-Benz Stadium, State Farm Arena |

| Downtown2 housing developments 'progressing steadily' in heart of downtown Peachtree Street renovation, new construction envisioned as "transformative" residential injection |

| DowntownImages: Large new shelter near Georgia Aquarium rounds into shape Salvation Army's Center of Hope to bring more beds, workforce development center, other features |

| BoltonNeighbors hope petition, campaign will squash townhome proposal Developers contend tweaked, trailside Bolton concept will benefit area, add needed housing |

| Georgia TechPhotos: Hurray for street makeovers in Midtown, through Georgia TechConnected 5th Street Complete Street, GT cycle track add safer passage across large intown swath |

| Old Fourth WardExclusive: Old Fourth Ward project 'The Bowery' won't include groceryThree-building Fuqua, Northwood Ravin development now underway on full Boulevard block |

| DowntownMARTA: Long pause for Atlanta Streetcar on horizon Months-long shutdown will address utilities, infrastructure upgrades; shuttle to be offered |

| River WestSuperstructure permit issued for casino portion at Bally’s Casino at 705 W. ChicagoThe casino and hotel tower are set to open in late 2026 |

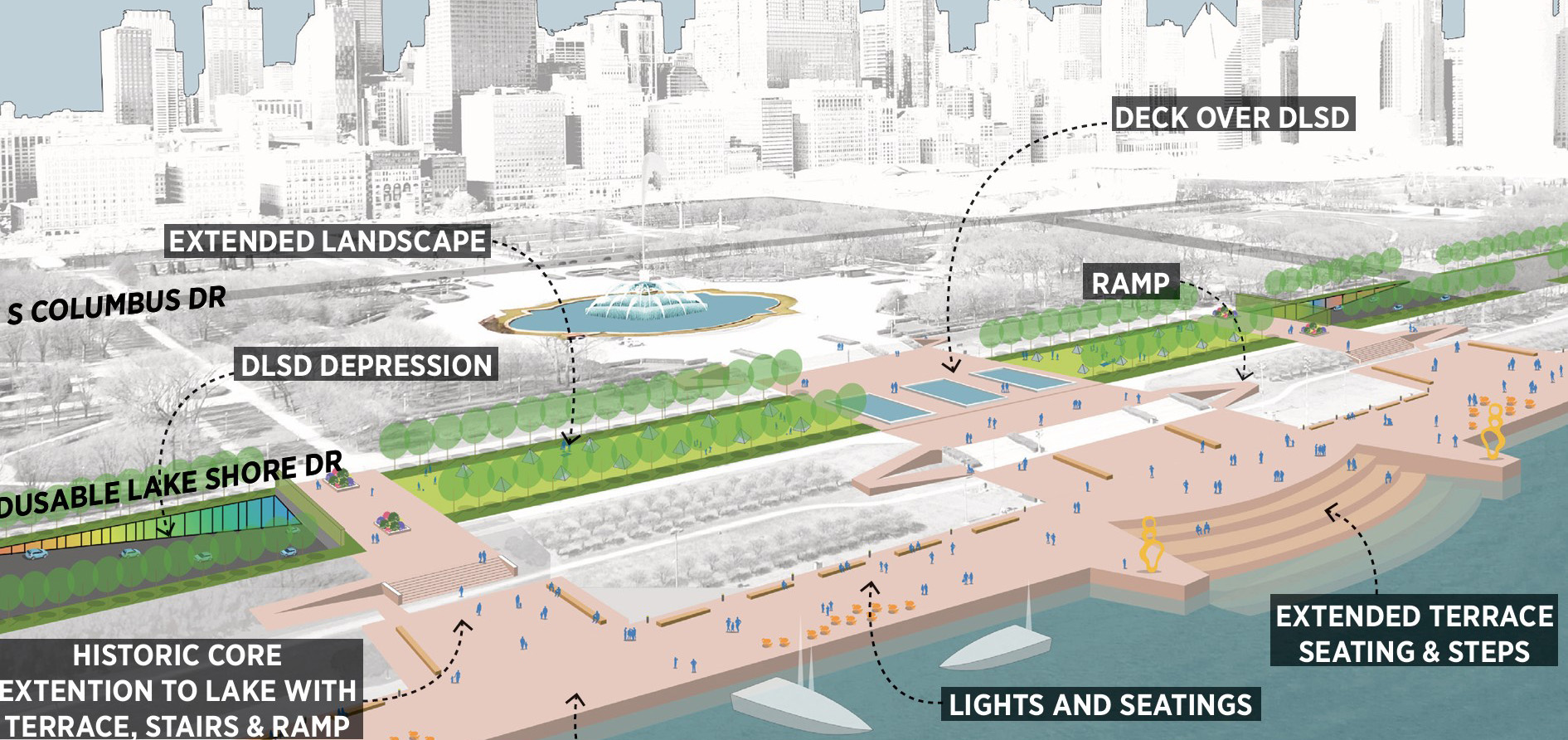

| The LoopPark District unveils concepts for Grant Park Framework PlanPlans envision capping Lake Shore Drive and reconfiguring park space |

| Roscoe VillageResidential development in the works at 2237 W. RoscoeZBA approved variations and a demo permit was issued |

| Fulton MarketFull building permit issued for development at 370 N. MorganConstruction on the 31-story tower is underway |

| Near West SideWesthaven Park Station completes construction at 145 N. DamenThe new 12-story building has 96 mixed-income units |

| LakeviewDemo permit issued to make way for development at 1805 W. GraceThe new five-story building will have 62 apartments |

| RegionalMetro's A Line extension to Pomona to open on September 19New stations in Glendora, San Dimas, and La Verne, and Pomona |

| DowntownL.A. City Council approves Bjarke Ingels-designed 670 Mesquit projectArts District tower complex would include housing, a hotel, and commercial space |

| KoreatownAdaptive reuse to create 495 apartments at 3550 Wilshire Blvd. in KoreatownAnother office-to-residential conversion by Jamison Services |

| Long BeachNew Habitat for Humanity project takes shape at 200 E. 14th St. in Long Beach36 condos - nearly half of which would be for lower-income buyers |

| DowntownColburn Center tops out at 2nd and Hill in DTLAFrank Gehry-designed complex is on track to open in 2027 |

| Altadena rebuilds, CicLAvia on August 17, and moreL.A. real estate, architecture, and urban planning news from the past week |

| Sunnyvale Kilroy Realty Sells Bay Area Campus for $365M The complex consists of three office and R&D buildings. |