Your City. Your Market. Your Next Deal.Stay up to date on national urban real estate |

|

📅 Today's Story: Roughly two-thirds of working-age renter households face “residual income” housing burdens—meaning they don’t have enough left after rent to afford basic needs like food, healthcare, and transportation.

AFFORDABLE HOUSING

Two-Thirds of Working Renters Can’t Afford Basic Needs |

|

📰 What Happened: Researchers from Harvard’s Joint Center ran the numbers and discovered that residual income metrics capture a much more nuanced picture of financials than the traditional 30% rent-to-income threshold. In total, 5.3 million American households fall through the cracks of the standard measure.

🔍 A Closer Look: Households earning below $45,000 are most affected, but the analysis also shows a surprising geographic reversal. Rural and lower-cost areas, like West Virginia, have the highest residual income burdens—not pricey cities like San Francisco. Even with average annual rents around $18,000, total household expenses exceed $57,000 for typical renters.

🧠 Why It Matters: The findings challenge current housing policy frameworks. While rent subsidies help, only direct and flexible income support—such as $1,000 monthly stipends—meaningfully reduce rent burdens. For policymakers, the message is clear: addressing affordability requires boosting incomes, not just lowering housing costs.

Joint Center for Housing Studies (Harvard University)

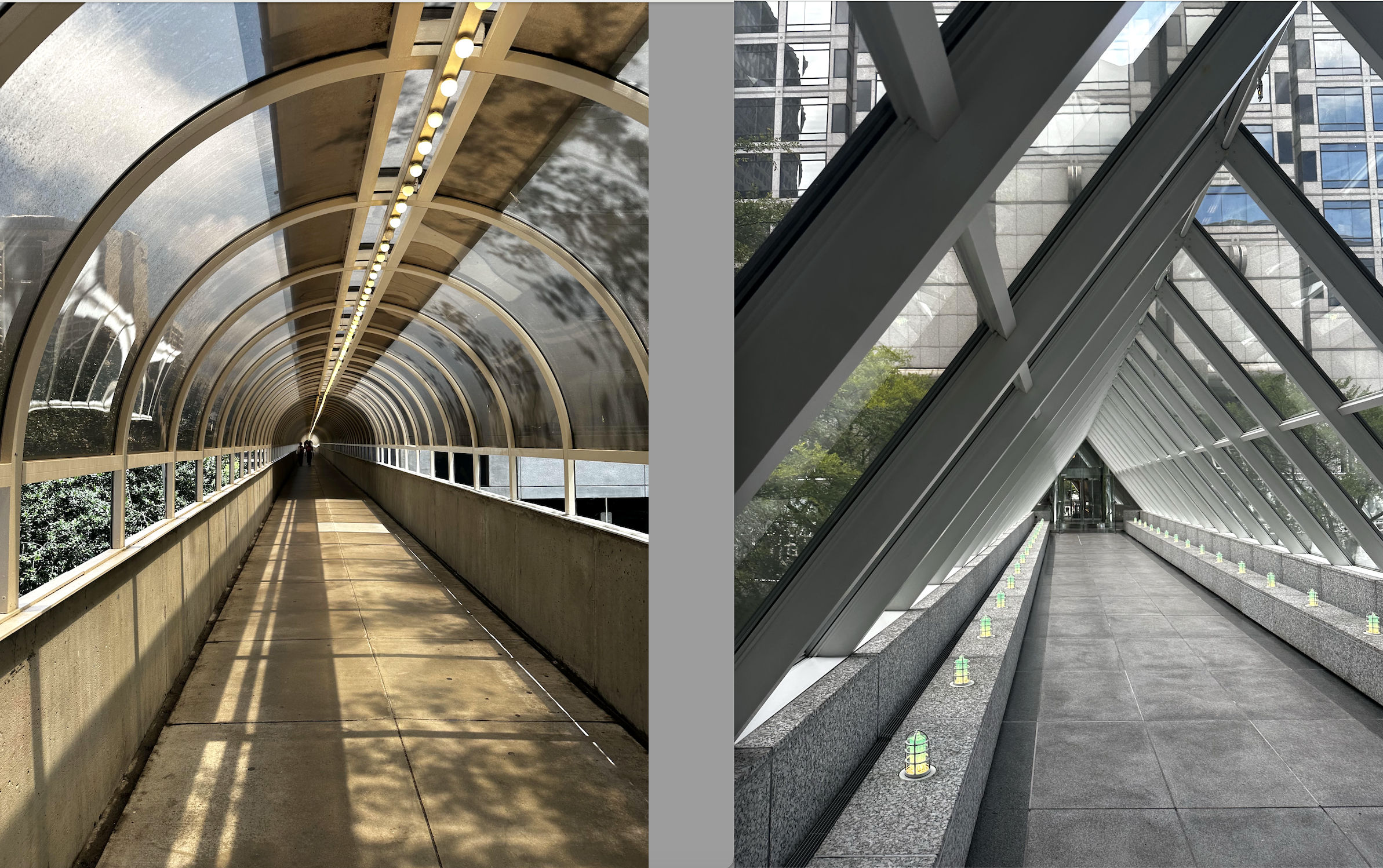

| DowntownLetter to Editor: Hands off Portman's iconic downtown skybridgesProfessor, writer responds to architect's proposal to redevelop elevated walkways as mixed-use notes |

| Georgia TechGoat Farm unveils creative hub for key downtown redevelopment site LOOP aims to debut at Georgia Tech’s planned Creative Quarter in time for 2026 FIFA World Cup |

| DowntownImages: How potential new district between Atlanta stadiums could lookRetail zone at Mercedes-Benz Stadium, Georgia World Congress Center doorstep remains hypothetical, leaders stress |

| O'HareCaisson permit issued for O’Hare Concourse DThe $1.3 billion project will bring 19 new gates to the airport |

| Ravenswood47th Ward Ald. Martin supports development at 4641 N. AshlandThe five-story building would rise next to the Our Lady of Lourdes School conversion |

| Elysian ParkDodger Stadium Gondola looks to get back on trackMetro releases supplemental environmental study for the $500M project |

| PalmsMixed-use development pushing dirt at 9431 Venice Blvd. in Palms47 apartments over ground-floor commercial space |

| Alondra ParkAffordable housing underway at 3127 W. 147th Street in Alondra ParkBrilliant Corners is building 78 apartments just west of Crenshaw Boulevard |